As the search engine giant, Google has a dominant market presence in Internet advertising by a significant margin. But Google doesn’t have a monopoly in every market. In Asia, in particular, local competitors have a great deal of importance within their own markets: Baidu in China; Naver in South Korea; and Yahoo with a stronghold over Japan.

As the search engine giant, Google has a dominant market presence in Internet advertising by a significant margin. But Google doesn’t have a monopoly in every market. In Asia, in particular, local competitors have a great deal of importance within their own markets: Baidu in China; Naver in South Korea; and Yahoo with a stronghold over Japan.

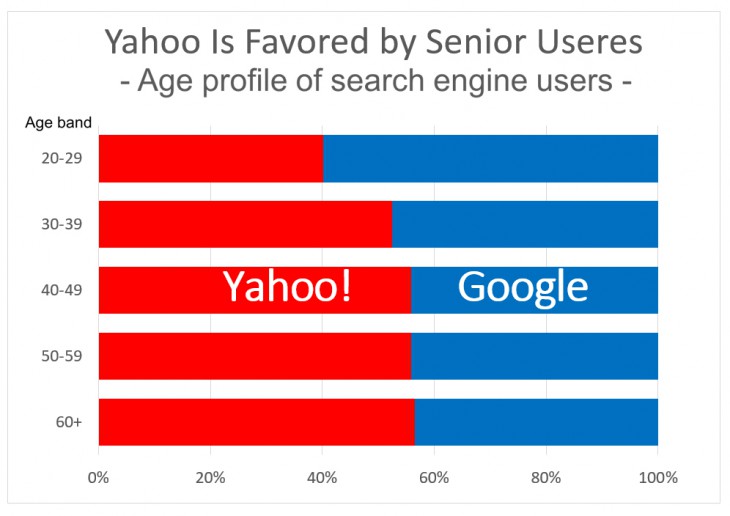

Please take a look at the figure on the lower right, which shows the search engine usage statistics for Japan. According to the statistical survey, Yahoo Japan (in red) has opened up a slight lead over Google (in blue) in terms of market share in Japan. It is true that Yahoo played a significant role in the early days of Internet services when they were first introduced to Japan in around 2000, and the company still maintains a strong brand image among search engine users in the country. But recent statistics indicate that younger people tend to use Google more often than Yahoo, suggesting that it would be no surprise if the current competitive situation was reversed between the two rivals in Japan in the coming years.

Next, let’s turn our attention to Internet advertising revenue. While not disclosing its business results to the public, Google Japan is believed to be enjoying continued growth in business centered on AdWords. In contrast, Yahoo Japan’s search interlocking advertising revenue has leveled off in recent years. (Please refer to the figure below.) The reason behind Yahoo Japan’s sluggish growth is that it failed to make up for the loss in the number of search engine audience members using personal computers (PCs) with the corresponding services provided to mobile phone users. Yahoo made a search engine deal in December 2010 to display Google search results. Ironically, this attempt has dragged its business in Japan down somewhat because Google has started to become pervasive in Japan as well, to the extent that its name is often used as a verb synonym for web searching by local users.

Note: The survey data were collected in the month of March 2015. 200,000 registered monitor members throughout the country were asked.

Source: Values Inc.

While struggling with its search interlocking advertising business, Yahoo is seeing consistent growth in display ad revenue, leveraging its extremely strong ability to attract a huge number of portal site visitors, totaling over 60 billion per month. Major contributors to this consistent growth are Yahoo! Display Ad Network (YDN) advertising, which was launched in January 2013, and Yahoo! Premium DSP (launched in January 2014). Both of these help advertisers to distribute optimized ads to mobile websites as well, leveraging extensive data related to user-specific search and browsing histories.

Yahoo! Premium DSP, in particular, is a full-fledged premium service leveraging technical support provided by a group of dedicated professionals, enabling advertisers to distribute ads only to those web pages with high exposure.

Note: Each fiscal year ended in March. IFRS principles were applied proactively from FY2013 onwards

Source: Compiled by this magazine from materials published by Yahoo Japan

Aranami Osamu, Corporate Officer in charge of the advertising business at Yahoo Japan Corporation, emphasizes the service strengths of Yahoo, saying, “Yahoo provides a media platform that is uniquely designed to accommodate features that are specific to individual ads, and this has made it possible for us to gain customer confidence among advertisers in Japan.” When it comes to website partnerships, Google works with a wide range of websites, whereas “Yahoo works with only a limited number of premium websites. This business approach has greatly improved matching accuracy, meaning that our customers are not concerned about the possible misplacement of their advertisements,” according to Aranami Osamu, Corporate Officer of Yahoo Japan.

Yahoo has made a new strategic move with the aim of taking advantage of the progress of display ads. A highlight of its strategy is related to the significant changes in the mobile websites and applications that were implemented on May 20, 2015. The new display ads are often referred to as “time-line ads,” allowing smartphone users to see the ads easily with the help of the enhanced visual attraction of the photographic advertisements. In this area of business, the company will remain focused on rolling out new products, including “in-feed ads” to be inserted in an article’s text, and “premium vision,” which are advertising videos.

Yahoo Japan has also embarked on a strategy to develop non-advertising income sources. In an attempt that is aimed at diversifying away from its advertising-related business, which currently accounts for around 80% in terms of operating profit, the company will start distributing game products on its own in June this year. Shiino Masamitsu, CEO of Gamebank, which is a joint venture company established with a venture capital fund, is extremely enthusiastic about the new business, saying, “We are looking forward to head-on competition, leveraging the strengths of Yahoo Japan.”

The company will have a new chairman on board this year. After the shareholders’ meeting in June this year, Nikesh Arora, a former executive of Google Inc., will become Chairman of Yahoo Japan. With the new top executive on board who knows Google inside out, competition between Yahoo Japan and Google will become fiercer than ever before.

Translated from “Nihon shijo de kikko suru yafu no hisaku — Sekai yusu no kyogo: Makerarenai tatakai (Yahoo’s strategy to compete with Google in Japan — World-class competition, A battle that cannot be lost),” Weekly Toyo Keizai, 13 June 2015, p.77. (Courtesy of Toyo Keizai Inc.) [June 2015]